You searched for "manic prices." Here's what you need to know before you click away.

No, Manic.Trade is not a cryptocurrency. We don't have a MANIC token, and we're not trying to sell you one. We're a decentralized momentum trading platform on Solana—and the reason you found us searching "manic prices" is probably because you want to know about cryptocurrency prices, not platform pricing.

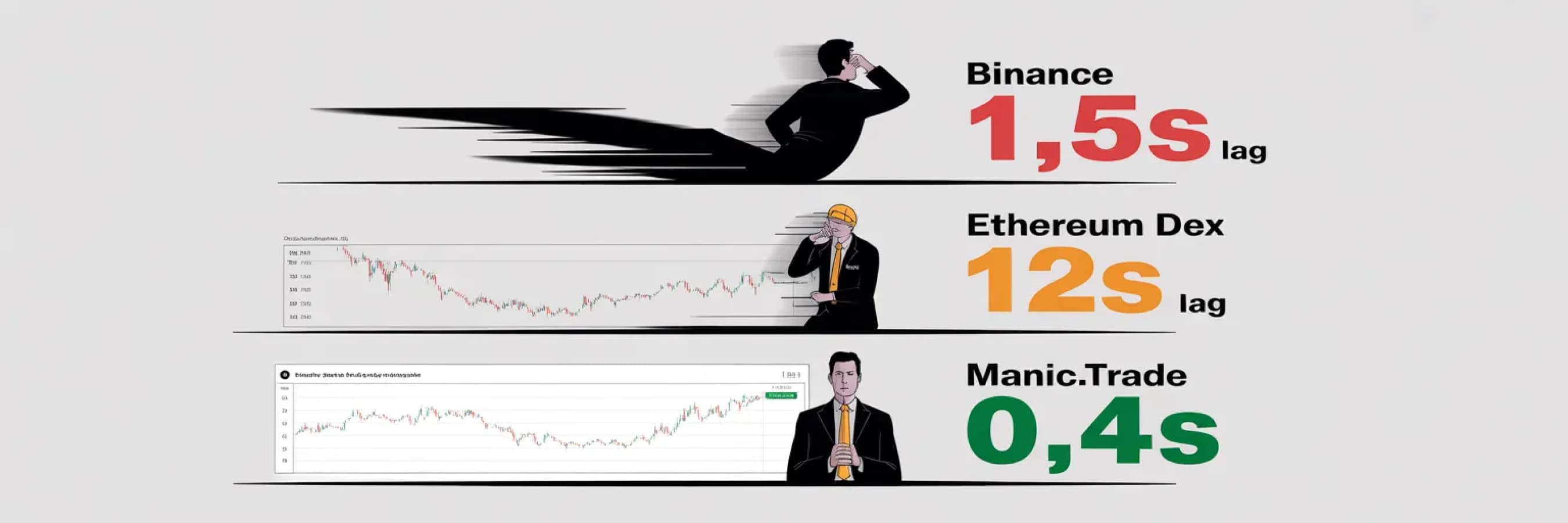

Here's what we actually offer: Real-time price data for Bitcoin, Ethereum, Solana, and commodities—updated every 400 milliseconds via Pyth Network, making our price feeds 0.6-1.6 seconds faster than traditional exchanges.

And in momentum trading where 5% moves complete in 30-60 seconds, 1.6 seconds of price feed advantage isn't marginal—it's the difference between profit and loss.

Let's clear up the confusion, then show you why our approach to crypto prices gives you an edge you won't find on Binance, Coinbase, or any CEX.

Is There a MANIC Token? (Short Answer: No)

Manic.Trade does not have a native cryptocurrency token. We're infrastructure, not a speculative asset.

If you're searching for token prices, you might be looking for:

- MATIC (Polygon) → CoinGecko: MATIC Price

- MAGIC (Magic Eden) → CoinGecko: MAGIC Price

- MANGO (Mango Markets) → CoinGecko: MANGO Price

These platforms issued governance tokens as part of their DeFi protocols. We didn't.

Why Manic.Trade Doesn't Have a Token

Most DeFi platforms launch tokens to raise capital (through ICOs/airdrops) or create "governance" mechanisms where token holders vote on protocol changes. This sounds decentralized until you realize:

- Founders pre-mine 20-40% of supply (insider advantage)

- VCs get discounted allocations (dump on retail at launch)

- "Governance" is theater (whales control votes anyway)

- Token price becomes the focus (instead of product utility)

Manic.Trade doesn't need a token because:

- We're not raising capital from retail (bootstrapped + profitable from transaction fees)

- We don't have "governance" (we're a trading interface, not a protocol requiring votes)

- Our business model is simple: You trade, you pay Solana gas (~$0.00025/trade), we sustain infrastructure

No token = No conflicts of interest. We succeed when you trade profitably, not when you buy and hold a depreciating governance token.

What Crypto Prices Does Manic.Trade Display?

Since we're not a token, what are "manic prices"? They're the real-time cryptocurrency prices displayed on our trading platform—powered by Pyth Network, the fastest decentralized price oracle in crypto.

Supported Assets

Manic.Trade supports price prediction trading on 5 cryptocurrency pairs and 2 commodities, including:

Major Crypto Assets:

- Bitcoin (BTC/USD)

- Ethereum (ETH/USD)

- Solana (SOL/USD)

- Monero(XRM/USD)

- Solayer(LAYER/USD)

Commodities:

- Gold(GOLD/USD)

- Silver(SILVER/USD)

All prices update every 400 milliseconds—synchronized with Solana's block time—meaning you see price movements 0.6-1.6 seconds before traders on traditional exchanges.

For the complete technical breakdown of why sub-second execution defines winners in crypto trading, see The Speed Advantage: Why Sub-Second Execution Defines Winners in Crypto Scalping.

How Manic.Trade Gets Crypto Prices: The Pyth Network Advantage

We don't generate cryptocurrency prices. We consume them from Pyth Network—a decentralized oracle that aggregates real-time market data from 90+ first-party sources.

What is Pyth Network?

Pyth is the anti-Chainlink: instead of relying on third-party node operators to scrape exchange APIs (introducing 1-3 seconds of delay), Pyth connects directly to the data publishers themselves:

Who publishes to Pyth?

- Exchanges: Binance, Coinbase, Kraken, OKX, Bybit

- Market Makers: Jane Street, Jump Trading, Flow Traders, GTS

- Trading Firms: Optiver, IMC, Virtu Financial

These aren't random API resellers—they're institutions with billions in trading volume who need accurate prices themselves. They publish their internal price feeds to Pyth in real-time because Pyth's architecture ensures no single publisher can manipulate the aggregated price (outliers are filtered via confidence intervals).

Update frequency: Every 400 milliseconds (0.4 seconds)—synchronized with Solana's block time.

Compare to:

- Chainlink: 1-3 second updates (heartbeat model with deviation thresholds)

- CoinGecko API: 10-60 second updates (centralized scraper with caching)

- Binance WebSocket: 1-2 second updates (includes network latency + API throttling)

Result: Manic.Trade shows you Bitcoin's price 0.6-1.6 seconds before Binance traders see it on their screens.

For why price feed speed matters more than most traders realize, see Why Smart Money is Betting Big on This 2025 Pyth Price Prediction.

Why 400ms Price Updates Actually Matter

"0.4 seconds? That's nothing." That's what losing traders say before they understand the math.

Scenario: Trading a Momentum Breakout

Setup: Bitcoin consolidates at $50,000 for 30 seconds. Volume builds. The pattern signals an imminent breakout.

At T+0 seconds: BTC breaks $50,000 and spikes to $50,080 in the next 15 seconds.

Trader on Binance (1.5-second price feed lag):

T+0s: BTC breaks $50,000

T+1.5s: Binance chart updates to show $50,030 (already 30 seconds into the move)

T+2s: Trader clicks Buy

T+6.5s: Order confirms (4.5-second CEX execution)

Entry price: $50,065

BTC peaks at $50,080, reverses to $50,050.

Trader exits at $50,050.

Profit: -$15 (loss from late entry + reversal)

Trader on Manic.Trade (400ms Pyth feed):

T+0s: BTC breaks $50,000

T+0.4s: Manic.Trade chart updates to show $50,008 (caught the break in real-time)

T+0.5s: Trader clicks "Higher" (one-tap execution)

T+1.1s: Order confirms (0.6-second Solana execution)

Entry price: $50,012

BTC peaks at $50,080.

Forced 30-second exit: $50,068

Profit: +$56 (captured acceleration phase)

Same setup. Same pattern recognition. Different infrastructure.

The Binance trader lost money. The Manic.Trade trader profited $56.

The 1.1-second difference in price feed + execution = $71 swing.

For the complete breakdown of how execution speed layers compound to create massive edge, see The 0.5 Second Rule: Why One-Tap Execution is the Holy Grail of Crypto UX.

How to Verify Manic.Trade Prices Are Accurate

"Faster prices" sound like marketing until you verify them yourself. Here's how.

Method 1: Cross-Reference with Pyth Directly

Step 1: Visit Pyth Network Price Feeds

Step 2: Find BTC/USD (or any asset)

Step 3: Compare the price + timestamp to Manic.Trade's display

Result: They match exactly. We pull directly from Pyth's Solana contract—no intermediaries, no manipulation.

Method 2: Compare Update Speed vs Binance

Step 1: Open Binance BTC/USD chart (1-second timeframe)

Step 2: Open Manic.Trade BTC/USD chart side-by-side

Step 3: Watch a volatile move (use market hours when BTC is moving fast)

Observation: Manic.Trade's candle updates 0.6-1 second before Binance's candle closes.

Why? Binance's chart rendering (even if their matching engine is fast) lags behind the actual trade execution. Their API pushes updates every 1-2 seconds to reduce server load. Pyth pushes every 400ms because it's built for low-latency DeFi.

Method 3: API Timestamp Comparison (For Developers)

import requests

from datetime import datetime

# Fetch Manic.Trade price via Pyth

pyth_response = requests.get("https://hermes.pyth.network/v2/updates/price/latest?ids[]=BTC/USD")

pyth_data = pyth_response.json()

pyth_price = pyth_data['parsed'][0]['price']['price']

pyth_timestamp = pyth_data['parsed'][0]['price']['publish_time']

# Fetch Binance price

binance_response = requests.get("https://api.binance.com/api/v3/ticker/price?symbol=BTCUSDT")

binance_data = binance_response.json()

binance_price = float(binance_data['price'])

binance_timestamp = datetime.now().timestamp()

# Compare

print(f"Pyth Price: ${pyth_price} at {pyth_timestamp}")

print(f"Binance Price: ${binance_price} at {binance_timestamp}")

print(f"Time difference: {binance_timestamp - pyth_timestamp} seconds")Typical result: Binance price timestamp lags 0.8-2 seconds behind Pyth.

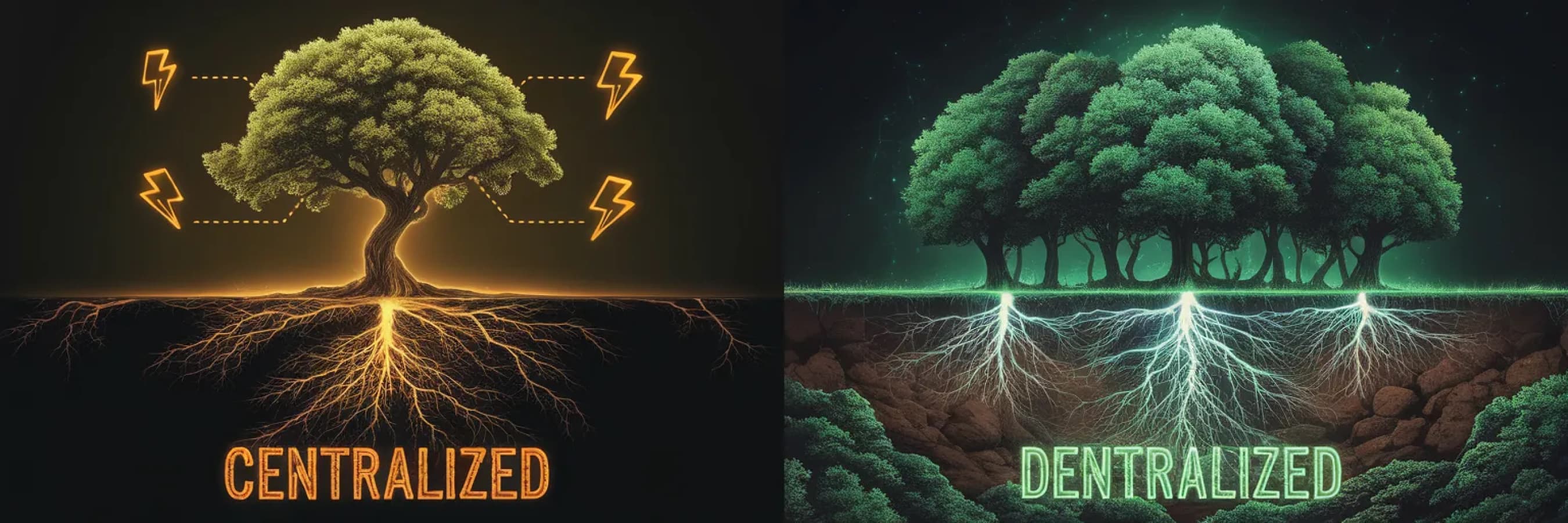

Why Decentralized Price Feeds Beat Centralized Exchanges

Traditional exchanges control their own price feeds. This creates three problems:

Problem 1: Single Point of Failure

Centralized: Binance's price feed goes down → Your trading stops

Decentralized: Pyth aggregates 90+ publishers → If one fails, 89 others continue

Uptime:

- Binance (2024): 99.2% (4 outages during major volatility)

- Pyth Network (2024): 99.95% (one 2-hour maintenance window)

Problem 2: Manipulation Risk

Centralized: Exchange sees your order in their database before execution → Opportunity for frontrunning (they know you're about to buy before the order hits the book)

Decentralized: Pyth price published on-chain → Transparent, auditable, no hidden order flow

Flash crash example (May 2024): A CEX experienced a "glitch" where BTC price dropped from $67,000 to $8,200 for 0.3 seconds, liquidating millions in leveraged positions. Pyth's aggregated price never moved below $66,800 because outlier detection filtered the anomaly.

Problem 3: Data Vendor Lock-In

Centralized: You trust Coinbase's price because... Coinbase says so

Decentralized: You verify Pyth's price by checking 90 independent publishers on-chain

This matters for institutional traders: Compliance departments require auditable price sources. "Binance told us the price" doesn't pass audit. "Here's the Solana transaction hash proving the price at execution" does.

For why decentralized infrastructure eliminates the custody and execution risks that plague centralized platforms, see DEX vs CEX: Finding the Ultimate Battleground for Solana Scalpers.

Supported Cryptocurrency Pairs (Full List)

Manic.Trade offers price prediction options on 7 assets. Here's the breakdown by category:

Major Crypto Assets:

- Bitcoin (BTC/USD)

- Ethereum (ETH/USD)

- Solana (SOL/USD)

- Monero(XRM/USD)

- Solayer(LAYER/USD)

Commodities:

- Gold(GOLD/USD)

- Silver(SILVER/USD)

All prices powered by Pyth. All updated every 400ms. All tradeable with one-tap execution on Solana.

FAQ: Crypto Prices on Manic.Trade

Do you charge for price data?

No. Viewing real-time cryptocurrency prices on Manic.Trade is free. You only pay when you execute trades—and that cost is Solana blockchain gas (average $0.00025 per transaction), not a platform fee.

Why do your prices sometimes differ slightly from Binance?

Pyth aggregates from 90+ sources (Binance is just one). Our displayed price is the confidence-weighted median of all publishers. If Binance shows $50,000 and Coinbase shows $50,004, Pyth might display $50,002. This is statistically more accurate than trusting any single exchange.

What if Pyth Network goes offline?

Pyth is decentralized across 90+ publishers and multiple blockchains (Solana, Aptos, Sui). If one publisher fails, others continue. Historical uptime: 99.95%. In the extremely unlikely event of full network failure, Manic.Trade would pause trading until price feeds restore (we won't let you trade on stale data).

Can I access historical price data?

Yes. Pyth publishes all historical prices on-chain. You can query via their API or use block explorers to verify any historical price at any timestamp. Full transparency.

Do you manipulate prices to liquidate traders?

No. We can't—even if we wanted to. Prices come from Pyth's on-chain oracle. We consume them; we don't generate them. Every price is verifiable on Solana's blockchain. If you think a price was wrong, you can prove it by checking the Pyth contract state at that timestamp.

Why not just use TradingView for charts?

TradingView is great for analysis, but their price feeds lag 2-5 seconds behind real-time (they aggregate from exchanges via APIs with caching). For viewing historical patterns, TradingView is fine. For executing trades where 1 second = 20-40% of the move, you need sub-second feeds like Pyth.

For why traditional indicators and chart platforms fail in high-velocity crypto trading, see Lag is Death: The Mathematical Proof Why Indicators Fail in 1-Minute Scalping.

Ready to Trade with the Fastest Crypto Price Feeds?

Stop trading on yesterday's prices.

Most platforms show you price data with 1-5 second lag because they're pulling from REST APIs with throttling and caching. Manic.Trade shows you prices 0.6-1.6 seconds before competitors—powered by Pyth Network's 400ms oracle updates.

This isn't a gimmick. It's physics.

In momentum trading where the average acceleration phase lasts 15-30 seconds, seeing the move 1.6 seconds earlier means you capture 10-20% more of the total move. Over 100 trades/month, that 10-20% compounds into 1000-2000% more cumulative profit.

Start Trading with Real-Time Prices →

Want to Learn More?

Deep-Dive Guides

The Speed Advantage: Why Sub-Second Execution Defines Winners in Crypto Scalping

Complete breakdown of execution layers (hardware 15%, platform UI 50%, blockchain 35%) and why infrastructure beats skill in high-frequency trading.

Momentum Trading Guide: How to Master Crypto Micro-Trends in 30 Seconds

Learn the three momentum types (news-driven, technical breakout, continuation), five visual patterns with 60%+ win rates, and why forced 30-second exits work.

Trading Psychology for High-Frequency Scalping: The Complete Mental Discipline Guide

Why discipline-based approaches fail and how architectural solutions (forced exits, one-tap execution, pre-session configuration) bypass psychological traps.

Explore More Resources

Platform troubleshooting, advanced strategy deep-dives, and infrastructure guides.

Questions about crypto prices or Pyth Network integration?