Key Takeaways

- The Complexity Trap: Iron Condors offer an illusion of safety through "defined risk," but often lead to over-engineering and paralysis in trending markets.

- The 70/30 Rule: While markets chop 70% of the time, the 30% trending regime is where market-neutral strategies become massive liabilities due to negative convexity.

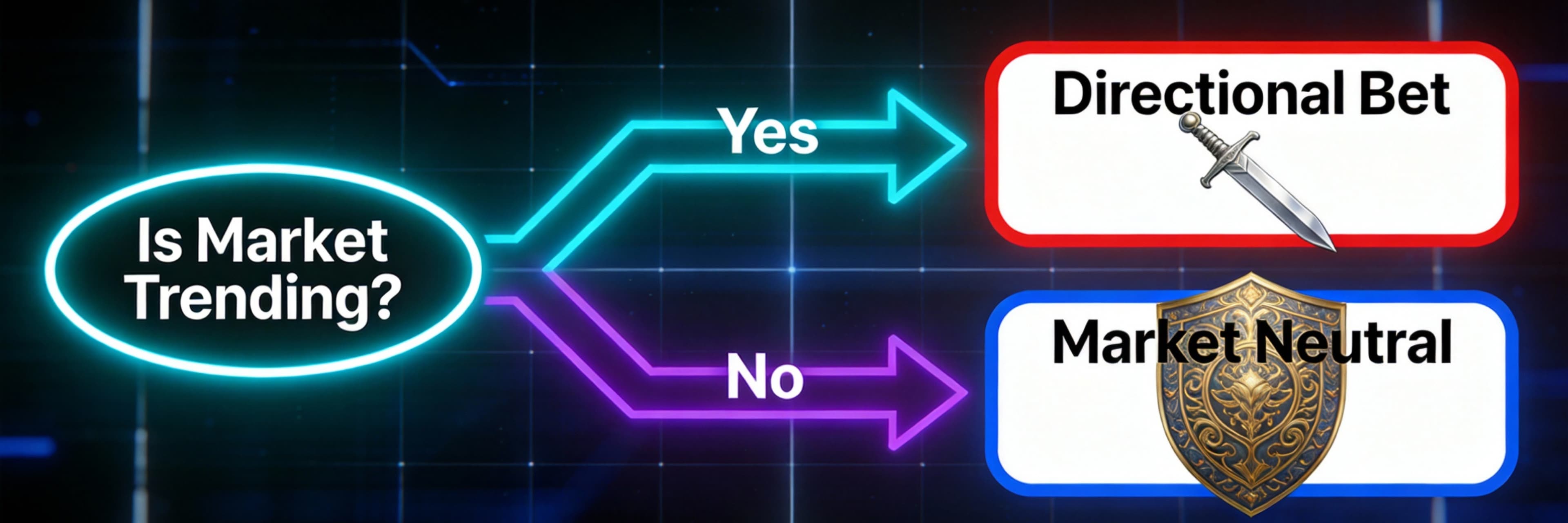

- Regime Awareness: Success depends on identifying the market environment (using AVWAP and IV Rank) before selecting a strategy, rather than forcing a neutral bias on a directional move.

- Simplicity Over Sophistication: Moving toward trend-aligned strategies like vertical spreads or long calls often yields higher capital efficiency and lower emotional exhaustion.

For many intermediate traders, the iron condor option strategy represents a rite of passage. It is often the first "sophisticated" setup a retail trader masters after graduating from simple long calls or puts. On the surface, the appeal is undeniable: it promises a way to generate consistent income by betting that a stock will stay within a specific range, effectively allowing you to "be the house" rather than the gambler.

At its core, an iron condor is a four-legged animal. It combines a vertical bull put spread and a vertical bear call spread, both with the same expiration date. By selling these two spreads simultaneously, you collect a net credit, creating a "profit zone" between your short strikes. As long as the underlying asset remains within this window, Theta decay works in your favor, eroding the value of the options you sold and padding your account balance. However, as noted in recent discussions on quantitative trading, the mathematical elegance of these spreads can often mask the underlying directional risks.

💡 Manic Philosophy: Traders hide behind complexity because they are afraid to make a call. "Market Neutral" is often code for "Indecisive." Real alpha comes from picking a side and riding the wave. Learn how to spot the wave in Surfing the Micro-Trend: How to Profit from 3-Candle Runs.

The Allure of the Iron Condor: Why Complexity Feels Like Safety

The Psychology of "Defined Risk"

The primary reason traders are drawn to this strategy—and why it often becomes a complexity trap—is the illusion of control it provides. Unlike naked selling, an iron condor has a strictly defined maximum loss. This "safety net" makes the strategy feel conservative, even when it is being deployed in volatile environments.

Traders are often lured by several key features:

- High Probability of Success: By structuring the trade outside the Expected Move, traders can create setups that have a theoretical 70% or 80% chance of expiring worthless. An options expert screens for high probability trades frequently, but high probability does not mean zero risk.

- Income Generation: It is marketed as a "monthly income" strategy, appealing to those who want to move away from the "hit or miss" nature of directional betting.

- The "Math" Factor: Using tools like Implied Volatility (IV) Rank, traders can identify periods where premiums are "rich," leading them to believe they have a statistical edge that overrides the need to understand market direction.

The Complexity Trap: When Math Meets Reality

While the mechanics of the iron condor are rooted in sound mathematical principles—such as mean reversion and the tendency for IV to be overpriced—the strategy carries a hidden danger: it requires the market to stand still. In a regime characterized by a strong directional bias, the very complexity that makes the iron condor feel professional becomes its greatest liability.

Recent market history is littered with stories of traders who fell into this trap. For instance, the "Captain Condor" phenomenon highlighted how retail investors, lured by the promise of outsized returns in short-dated contracts like 0DTE (zero days until expiry) options, experienced catastrophic losses when the market broke out of its expected range. When a trending market hits a "market-neutral" strategy, the margin for error becomes razor-thin.

The complexity of managing four different legs can lead to "analysis paralysis." Traders often spend so much time calculating breakevens and monitoring Expected Move data that they ignore the most obvious signal on the chart: the trend. As we delve deeper into the Iron Condor option strategy vs Trend Following debate, it becomes clear that focusing on "delta-neutral" stability can distract you from the more profitable path of following market momentum.

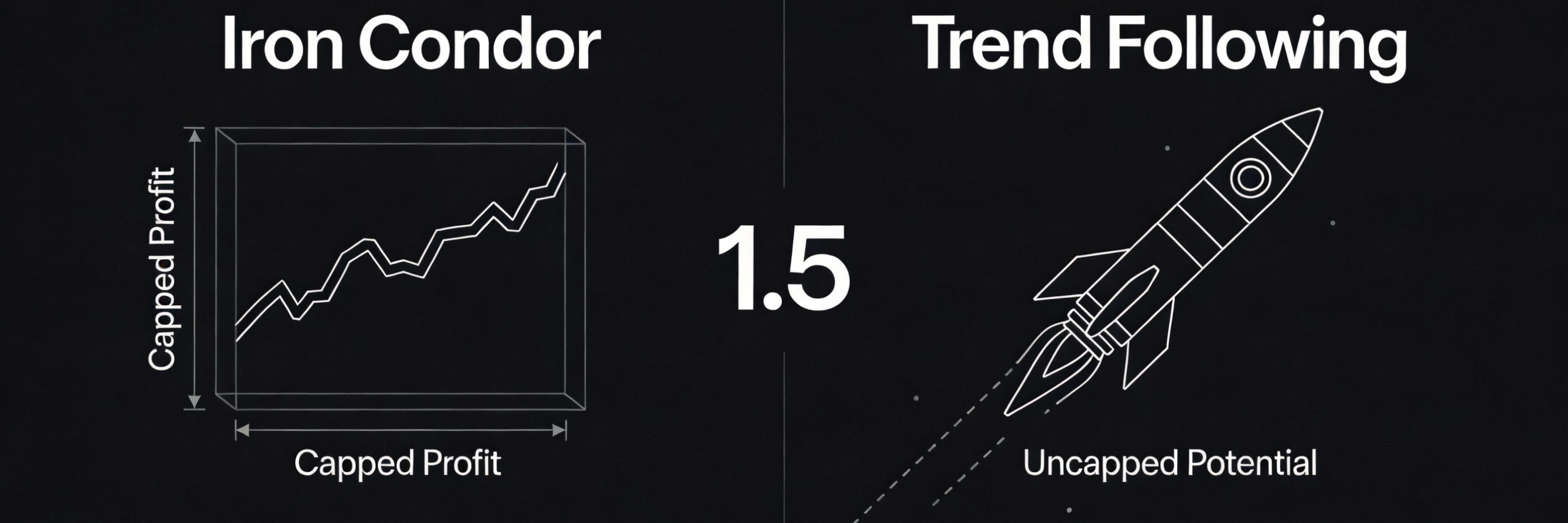

⚔️ Strategy Face-Off: Neutral vs. Directional

| Feature | Iron Condor (Neutral) | Trend Following (Directional) |

|---|---|---|

| Structure | 4 Legs (Complex) | 1-2 Legs (Simple) |

| Profit Potential | Capped (Limited to credit) | Uncapped (Rides the trend) |

| Best Environment | Choppy / Sideways | Trending / Breakout |

| Risk Profile | High Win Rate / Low Payoff | Lower Win Rate / Massive Payoff |

| Mental Load | High (Constant adjusting) | Low (Set and forget) |

The 70/30 Rule: When Market-Neutral Strategies Become Liabilities

In the world of quantitative finance and derivatives trading, there is a fundamental observation often referred to as the "70/30 Rule." Historically, financial markets spend approximately 70% of the time in a range-bound, "choppy" state characterized by mean reversion. During these regimes, the Iron Condor thrives on Theta decay and the tendency of price to stay within the expected move defined by Implied Volatility (IV).

However, it is the remaining 30%—the trending market regime—where complexity becomes a liability. When a market enters a period of significant appreciation or a sustained sell-off, the delta-neutral profile of an Iron Condor transforms from a benefit into a mathematical trap.

Why Iron Condors Fail in Trending Regimes

The failure of the Iron Condor option strategy vs Trend Following in a 30% trending environment stems from three primary mechanical pressures:

- Gamma Risk and Directional Bias: As the underlying asset breaks out, the "Delta" of your short strikes increases rapidly. What began as a market-neutral position develops a heavy directional bias against the trend, forcing "chasing" adjustments.

- The Volatility Expansion Trap: In many trending regimes—especially bearish ones—Implied Volatility (IV) Rank may spike. Since an Iron Condor is a "vega short" strategy, an increase in IV expands the value of the options you sold, resulting in unrealized losses even if price hasn't touched your break-even.

- Negative Convexity: Unlike trend-following strategies that benefit from momentum, the Iron Condor has a capped profit and uncapped (relative to credit) risk. In a "30% trend" scenario, velocity exceeds the expected move, rendering the statistical edge moot.

Signs You're Falling into the Complexity Trap

Let’s be honest: you didn’t start trading to become a full-time risk manager for a "market-neutral" position that requires constant babysitting. If you find yourself deep in the weeds of an Iron Condor option strategy vs Trend Following debate, you are likely caught in a "competence trap," where you believe more data or more legs can outsmart a trending market.

The Symptoms of Over-Engineering

In a trending market, complexity is often a mask for denial. You aren't "managing risk"; you are fighting the tape. Here are the warning signs:

- Ignoring the AVWAP and Directional Bias: If price is consistently above the Anchored Volume Weighted Average Price (AVWAP) and making higher highs, but you are still adding call credit spreads to "balance" your Delta, you are choosing a mathematical model over price reality.

- The Adjustment Death Spiral: Are you rolling tested sides or widening wings more than actually entering new trades? If you are stuck in a loop of infinite complexity in your tasks, you aren't mastering your craft; you’re just busy.

- Information Overload and Hypervigilance: You check your Greeks every ten minutes, seeking a sense of control that doesn't exist. This hypervigilance is a sign that your strategy is owning you.

🚀 Simplify Execution: Stop adjusting 4 legs. Start executing 1 click. Speed beats complexity every time. Learn why simple execution is the holy grail in The 0.5 Second Rule: Why “One-Tap Execution” is the Holy Grail.

How to Identify the Current Regime (Before You Place the Trade)

Before you even think about opening the trade tab, you must answer one fundamental question: Is the market currently in a mean-reverting range or a persistent trend? To avoid the "complexity trap," use these three quantitative pillars to diagnose the environment.

1. The Anchor: AVWAP Angle and Price Action

The Anchored Volume Weighted Average Price (AVWAP) ties price to volume since a specific event.

- The Trend Signal: If the AVWAP is sloping upward steeply and price holds above it, the market is in a "trending regime." Iron Condors are dangerous here.

- The Range Signal: If the AVWAP is flat and price oscillates around it, the market is range-bound. This is the "Goldilocks" zone for Iron Condors.

2. The Volatility Filter: IV Rank and Percentile

Understanding Implied Volatility (IV) is the difference between an amateur and a professional.

- The Rule of Thumb: If IV Rank is below 30%, the "volatility premium" is thin. Selling an Iron Condor offers poor risk-to-reward. If IV Rank is above 70%, premiums are attractive—provided price action confirms a range.

3. The Volume Profile: Identifying High-Volume Nodes

- Inside the Value Area: If price is stuck between two high-volume nodes, it acts as a magnet, supporting the Iron Condor.

- The Low-Volume Void: If price breaks out into a "volume gap," it moves rapidly. This is a clear signal to shift toward trend following.

The 'One-Foot Bar' Rule: Simplifying Your Options Playbook

There is a dangerous seduction in complexity. Many believe more "legs" or sophisticated adjustments equal professionalism. This is how traders end up trying to solve a 500-piece puzzle while the house is on fire. To escape, adopt the "One-Foot Bar" rule: look for the one-foot bar you can step over rather than the seven-foot bar you must jump.

Strip Away the Noise

The most effective market participants understand that "killing the clutter" is the ultimate form of sophistication. If the chart moves from bottom left to top right, the Directional Bias is clear. Forcing an Iron Condor option strategy vs Trend Following approach here is like arguing with a tidal wave.

Simplicity is your greatest edge. While the "brilliant" trader is busy calculating adjustments for a struggling Iron Condor, the simple trader has already entered a trend-aligned position and let the market do the heavy lifting.

Conclusion: Choosing Compatibility Over Sophistication

True mastery in the markets often mirrors the philosophy of leveraging mature, well-understood tools to produce superior results. In trading terms, a simple trend-following approach is the "mature technology." It may not have the "flashy" appeal of a four-legged spread, but it focuses on the outcome: capturing the Expected Move.

Aligning Strategy with Reality

Just as complex systems require risk management, your portfolio requires strategy-market compatibility. To avoid the complexity trap, follow these principles:

- Prioritize Environment over Mechanics: If the trend is clear, stop fighting for Mean Reversion.

- Conduct "Compatibility Testing": Are you using a range-bound tool in a breakout environment? If the market build changes, your strategy must change.

- Embrace Functional Simplicity: A long call or vertical spread often provides better profiles during trending periods than a struggling market-neutral position.

The best strategy is never the one with the most legs—it is the one that aligns most seamlessly with the market's current reality. Stop managing the trap, and start trading the trend.

FAQ

1. Is the Iron Condor a "bad" strategy?

No, it is a highly effective strategy for range-bound markets (the 70% of the time markets chop). It only becomes a "bad" strategy when forced into a trending regime where its negative convexity works against the trader.

2. How do I know when to switch from Iron Condors to Trend Following?

Monitor the AVWAP angle and price action relative to the Expected Move. If price consistently holds above/below the AVWAP and breaks the 1-standard deviation expected move with high volume, the regime has likely shifted to trending.

3. Why is an Iron Condor called a "complexity trap"?

Because it involves four legs and requires constant adjustments (rolling strikes, managing deltas) when the market moves. Traders often focus so much on these "sophisticated" adjustments that they lose sight of the fact that the underlying trend has made the trade mathematically non-viable.

4. What is the best trend-following alternative for an options trader?

Bull Call or Bear Put Vertical Spreads are excellent alternatives. They provide a directional bias, have a lower cost of entry than long calls (due to the sold leg offset), and benefit from the trend rather than being hurt by it.

5. Does High IV Rank always mean I should sell an Iron Condor?

Not necessarily. High IV Rank often occurs during sharp market sell-offs (trending down). While premiums are high, the directional velocity can easily blow through your "safety" wings. Always confirm that price action is stabilizing before selling neutral spreads.

Related Reading

This article is part of our comprehensive guide: Trading Psychology for High-Frequency Scalping: The Complete Mental Discipline Guide.

Discover why 90% of scalpers fail psychologically, the 5 core mental traps destroying traders, and the architectural solutions that eliminate discipline failure without relying on willpower.