Key Takeaways

- The "Simulated" Reality: Most modern options prop firms provide access to simulated capital, not live brokerage accounts, paying successful traders out of evaluation fees.

- The Evaluation Trap: Strict 30-day windows and trailing drawdowns are designed to exploit psychological weaknesses, leading to a 95% failure rate for retail participants.

- Risk Management is King: Success in a prop environment requires "military-level" discipline and a deep understanding of the Greeks, rather than just directional guessing.

- Strategic Tool, Not a Shortcut: A funded account is a powerful leverage tool for traders with a proven edge, but it is a "leased" environment with rigid operational constraints.

What is the Reality of Options Prop Trading from 2024 to 2026?

The landscape of options trading has undergone a seismic shift, moving from the exclusive pits of Chicago and New York to the digital screens of retail traders worldwide. As we navigate through 2024, the concept of a prop firm for options trading has evolved into two distinct realities: the traditional institutional desk and the modern online evaluation model. Understanding the friction between these two is essential for any trader looking to scale their trading edge without falling into common industry traps.

The Evolution of the Retail Options Environment

The surge in interest regarding options prop firms is no accident. Market data indicates a massive 340% growth in retail options adoption between 2019 and 2024, a phenomenon Goat Funded Trader attributes to the democratization of sophisticated financial instruments. This explosion was fueled by a "race to zero" among major brokers like Robinhood and SoFi, who eliminated the standard per-contract fees that once made active management prohibitively expensive.

Furthermore, the market itself has become more volatile and fast-paced. According to Cboe, recent years saw record-breaking volumes, particularly in zero-days-to-expiry (0DTE) options, which now represent a staggering 59% of total SPX volume. In this high-velocity environment, retail traders often find themselves "capital-constrained"—possessing a viable strategy but lacking the significant margin required to survive the intraday swings of the S&P 500.

Distinguishing the Two Models

To understand the current reality, one must distinguish between the "Old Guard" and the "New Wave" of proprietary trading:

| Model Type | Capital Source | Entry Requirement | Employment Status | Primary Audience |

|---|---|---|---|---|

| Institutional Prop Desk | Firm's live capital | Elite pedigree, interviews | Salaried employee/partner | Professional traders in financial hubs |

| Online Evaluation Model | Simulated capital (demo) | Pay evaluation fee | Independent contractor | Retail traders worldwide |

| Hybrid Firms | Live capital after proving alpha | Pass rigorous evaluation | Performance-based payout | Top 5% of retail talent |

- Institutional Prop Desks: These are traditional firms that hire traders as employees or partners. They provide a base salary, professional-grade tools, and direct market access. However, they require elite pedigrees and physical presence in financial hubs.

- The Online Evaluation Model: This is the "prop firm" most retail traders encounter today. These firms offer a funded account based on a "pay-to-play" system. Traders pay a fee to enter an evaluation phase, where they must hit a profit target while adhering to strict risk management rules.

The Mechanics of Modern Options Prop Firms

From 2024, the reality of online options prop trading is built primarily on simulated capital. Unlike equity prop firms that have existed for years, options prop firms must provide sophisticated platforms capable of real-time Greeks calculations—delta, gamma, theta, and vega—to ensure the trader's environment mirrors live market conditions.

If a trader passes the evaluation, they move to a "funded" status. The core appeal here is the profit split, which often allows the trader to keep 60% to 90% of their gains. However, the "reality" is that these firms operate under a "Leased Capital" framework. You are not given a check; you are given access to a sub-account where the firm's maximum drawdown rules act as a hard ceiling. If your account value drops below a certain threshold, the account is liquidated instantly. This is the same principle behind why proper risk management systems separate professionals from gamblers—one mistake triggers total loss.

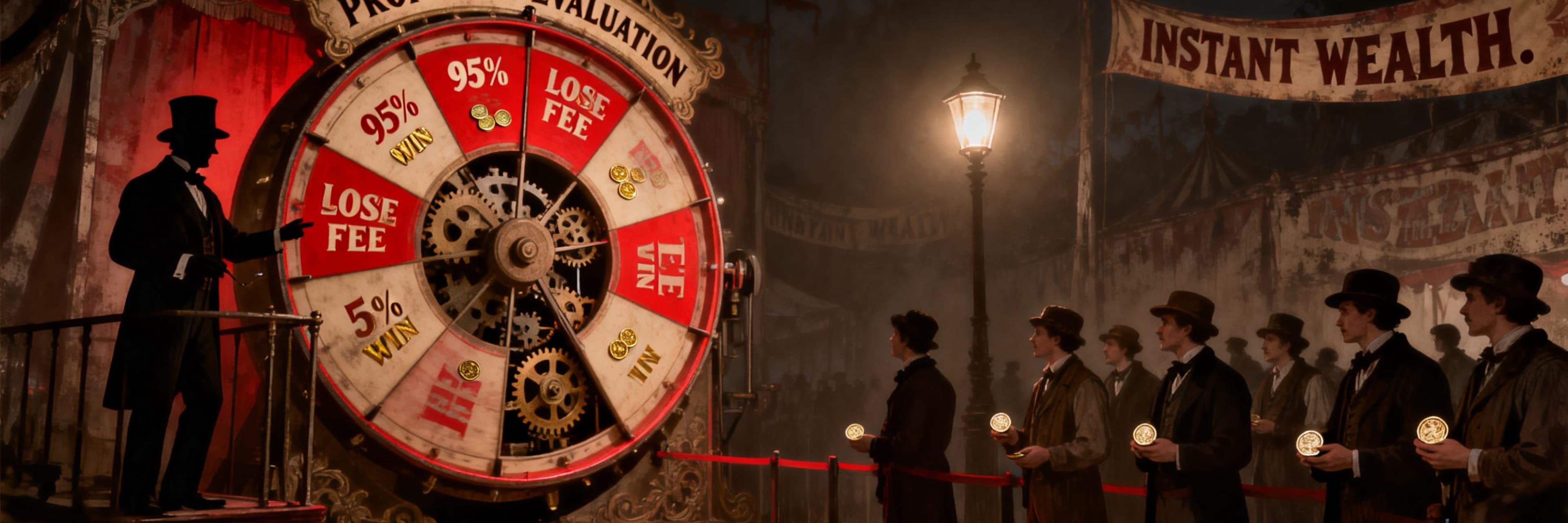

How Prop Firms Actually Make Money (The Hidden Math)

To the uninitiated, the business model of a prop firm for options trading looks like a symbiotic partnership: they provide the liquidity, you provide the trading edge, and you both split the spoils. However, if you pull back the curtain on the "modern" retail prop industry, the math tells a much more cynical story. While traditional firms focus on high-frequency precision or macro-driven trends, the retail-facing sector often operates on a model of "churn and burn."

The Revenue Pivot: Fees Over Alpha

In a traditional setting, a firm risks its own capital to capture market inefficiencies. But for many modern firms, the primary revenue stream isn't the profit split from successful traders—it's the evaluation phase fees.

The mathematical reality is that the vast majority of applicants fail before they ever see a funded account. This creates a "demo-to-drain" pipeline where the firm collects entry fees from thousands of traders, knowing statistically that most will hit their maximum drawdown limits within the first month. In this ecosystem, the trader isn't the partner; they are the product.

The "Simulated Capital" Illusion

One of the industry's best-kept secrets—often shared by those who worked at major prop firms—is that many "funded" traders aren't actually trading live capital. Instead, they operate on simulated capital in a demo environment.

| Trader Status | What You Think You're Trading | What You're Actually Trading | How Firm Makes Money |

|---|---|---|---|

| Evaluation Phase | "Testing your skills" | Pure demo account | Collects evaluation fees from 95% failures |

| "Funded" Account (Most) | Live market capital | Simulated/demo capital | Pays winners from loser evaluation fees |

| "Funded" Account (Top 5%) | Live market capital | Actually mirrored to live trades | Keeps portion of your real market profits |

- The Churn Model: If a trader is successful in a simulation, the firm pays them out from the pool of evaluation fees collected from unsuccessful traders.

- The Mirroring Strategy: Only when a trader proves consistent "alpha" does the firm take the step of mirroring those trades in a live account to generate real market profit.

Why the Rules Are Stacked Against You

The risk management rules—such as prohibitions on weekend holding or restrictions on trading during news events—are often marketed as "teaching discipline." In reality, they are designed to narrow the window of success. This is the exact trap that complexity creates for traders—not because the strategies are bad, but because artificial constraints obscure what actually works.

As noted by industry insiders, the "real money" in the markets is often made on macro-driven moves that develop over several days or weeks. By forcing traders into high-frequency, intraday "scalping" strategies through tight drawdown limits and time constraints, firms push participants toward the "randomness" of short-term price action.

The hidden math is simple: the more a firm restricts your holding time and forces high-leverage participation, the higher the probability you will trigger a violation, forfeit your fee, and restart the cycle. For the firm, the goal isn't necessarily to find the next market wizard; it's to maintain a high-volume "evaluation trap" where the house always wins, regardless of which way the S&P 500 moves.

💡 Pro Tip: The House Profits From Your Attempt, Not Your SuccessHere's the uncomfortable truth: if 10,000 traders each pay a $300 evaluation fee, that's $3 million in revenue before a single live trade executes. If 95% fail within 30 days, the firm keeps $2.85 million and only needs to pay out $150k to the 5% who pass—funded from the fees, not market profits. Your evaluation fee isn't "renting capital"—it's buying a lottery ticket where the odds are mathematically designed against you. Before paying to prove yourself, master minimalist trading principles in your personal account first. If you can't survive without artificial time pressure, you won't survive with it.

The Pros and Cons of Trading Options with Firm Capital

Deciding to use a prop firm for options trading is a strategic pivot that shifts a trader's focus from capital accumulation to pure execution. While the allure of managing a six-figure funded account is strong, the transition from retail brokerage to a proprietary environment introduces a unique set of trade-offs.

The Advantages: Scaling Without Personal Risk

The primary appeal of a prop firm is the ability to decouple your trading edge from your personal bank account. For many retail traders, the "Pattern Day Trader" (PDT) rule and limited liquidity are the biggest hurdles to scaling.

- Access to Significant Leverage: Prop firms provide the "buying power" that would otherwise take years of personal saving to accumulate. This allows traders to execute complex spread strategies or large-scale directional plays that are capital-intensive.

- Capped Personal Financial Risk: In a traditional brokerage setup, a "black swan" event can lead to losses exceeding your initial deposit. In a prop firm, your risk is generally limited to the fee paid for the evaluation phase.

- Professional Infrastructure: Many reputable firms provide access to advanced platforms like cTrader or MT5, which often feature better execution speeds. Some firms even offer 90%-100% profit splits, allowing successful traders to retain the vast majority of their gains.

- Educational Discipline: The basics of prop trading emphasize that strict risk management rules—such as daily loss limits—act as a "forced mentor," preventing the emotional revenge trading that often wipes out retail accounts.

The Drawbacks: The Reality of "Simulated" Constraints

Despite the marketing promises, trading with a firm is not "free money." The model is built on a foundation of strict mathematical boundaries.

- Strict Drawdown Rules: Unlike a personal account where you can weather a temporary dip, prop firms utilize a maximum drawdown limit. If your account equity touches this level, the account is often liquidated instantly. This makes high-volatility strategies extremely difficult to manage.

- The "Evaluation Trap": High-pressure time limits can force traders to take sub-optimal setups to hit a profit target, leading to forced errors. While some modern firms have removed time limits to reduce this pressure, the psychological weight remains.

- Complexity and Expiration Risk: Options are decaying assets. When you combine the natural expiration risk of an option contract with the firm's strict daily loss limits, the margin for error becomes razor-thin. A sudden spike in volatility can trigger a breach of risk rules even if the underlying stock price hasn't moved significantly.

- Profit Split Trade-off: While 70-90% profit retention sounds generous, remember: in a personal account, you keep 100%. The split only makes sense if the capital access enables trades you literally couldn't execute otherwise.

| Factor | Personal Brokerage Account | Prop Firm Funded Account |

|---|---|---|

| Capital Scale | Limited by personal savings | $25k-$250k+ immediately |

| Risk Exposure | Unlimited personal loss potential | Capped at evaluation fee |

| Profit Retention | 100% of gains | 70-90% split (firm takes cut) |

| Trading Rules | Your rules only | Strict daily limits, drawdowns, time windows |

| Psychological Pressure | Self-imposed | External evaluation metrics |

| Best For | Patient compounders, unlimited time horizon | Proven strategies needing scale now |

Common Pitfalls: Why 95% of Options Traders Fail Challenges

The allure of a high-leverage funded account often blinds retail participants to the statistical reality. While marketing materials highlight "freedom," the data suggests a grimmer outlook: approximately 90% to 95% of participants fail. This isn't necessarily due to a lack of market knowledge, but rather a catastrophic failure to navigate the specific structural hurdles of a prop firm for options trading.

The Arbitrary Deadline: The 30-Day Evaluation Trap

One of the most significant obstacles is the rigid evaluation phase timeline. Many firms impose a 30-day window to hit a specific profit target. When traders are forced to "make it happen" within four weeks, they stop trading the market and start trading the clock. This leads to:

- Forcing trades during low-probability setups.

- Over-leveraging positions to compensate for a slow start.

- Ignoring market context in favor of desperate "Hail Mary" plays.

The "Military-Level" Discipline Deficit

As noted by industry veterans, while equity trading requires standard discipline, options trading demands "military-level" discipline. Most retail traders approach a prop firm with a gambling mindset rather than a business plan. They fall victim to "revenge trading" after a loss, allowing their ego to dictate their next move rather than their risk management rules.

The Psychological Trap of "Trading for the Payout"

Perhaps the most dangerous pitfall is shifting focus from the process to the profit split. When a trader's primary motivation is the upcoming payout rather than the execution of a proven system, their psychology becomes fragile.

- Daily Loss Limits: Most firms implement strict daily stops. A trader focused on the payout often views these limits as a challenge to be skirted rather than a safety net.

- The Cycle of Chasing: After a minor setback, the desire to recover capital quickly leads to ignoring position-sizing rules.

- Lack of Confluence: Success comes from seeing different dimensions of evidence—price, time, and momentum—aligning, rather than hoping for luck. This is why the art of momentum trading emphasizes structural breaks over arbitrary time targets.

⚡ Reality Check: The Evaluation Phase Isn't Training—It's a FilterProp firms market evaluations as "skill development," but the 30-day window isn't designed to teach you—it's designed to eliminate you. Professional traders take months to validate a strategy through hundreds of backtested scenarios. But evaluation rules force you to hit profit targets on a deadline, incentivizing gambling over process. If your edge requires patience to compound (which real edges do), the artificial urgency ensures failure. Don't pay for an evaluation until you can demonstrate 90+ consecutive days of profitable trading in a personal simulator—without time pressure. The evaluation fee should validate an existing edge, not discover one.

Key Features to Look for in a Reputable Options Prop Firm

Navigating the landscape requires a discerning eye. For intermediate traders in the United States, selecting a firm isn't just about the highest profit split; it is about infrastructure, transparency, and the reliability of the payout pipeline.

Payout Reliability and Speed

The ultimate litmus test for any prop firm is how they handle withdrawals. A reputable firm should have a documented history of timely payouts. According to industry standards, weekly payouts are becoming the baseline. Some traders use Atlas Funded to find firms that offer no-minimum trading day requirements, which speeds up the time to the first withdrawal.

Red Flags:

- Requiring 20+ trading days before first payout

- Vague payout terms hidden in fine print

- Reddit threads filled with withdrawal complaints

- Firms that don't publish payout timelines publicly

Transparency of Risk Management Rules

A "red flag" is the "gotcha" rule—complex, poorly defined constraints designed to trigger a violation. A reputable firm prioritizes rules that mirror real-market discipline.

- The "60-Second Risk Pause": As highlighted in industry discussions, if you cannot pause risk in 60 seconds, your prop firm is not ready. This refers to the firm's technical ability to manage exposure during extreme volatility.

- Drawdown Logic: Understand whether the maximum drawdown is "static" or "trailing." Trailing drawdowns are significantly harder to manage and are a common feature of evaluation-heavy models.

Platform Stability and Asset Variety

Options trading is sensitive to execution speed and Greeks. If a firm's platform lags, your trading edge will evaporate. Look for firms that either support robust third-party platforms like NinjaTrader or provide proprietary interfaces with built-in Greeks and risk calculators.

| Feature | Why It Matters | What to Look For |

|---|---|---|

| Payout Speed | Validates firm actually has capital | Weekly payouts with no minimum days |

| Drawdown Type | Determines difficulty level | Static > Trailing (easier to manage) |

| Platform Stability | Affects execution quality | Third-party integrations (NT, MT5) |

| Rule Transparency | Prevents "gotcha" violations | Publicly documented, no hidden clauses |

| Community Reputation | Social proof of legitimacy | Active Reddit/Discord with payout proof |

Prop Trading vs. Personal Account: Which is Right for You?

Choosing between a prop firm for options trading and a personal brokerage account is a question of psychological temperament and strategic positioning. Both paths offer distinct advantages.

The Personal Account: Autonomy and Slow Growth

For many retail traders in the United States, the journey begins with a personal account at a major brokerage like Fidelity or Charles Schwab. The primary advantage is total autonomy. You own 100% of your profits, and there are no risk management rules imposed by a third party. However, the downside is "capital thirst." Compounding a $2,000 account to a living wage can feel agonizingly slow.

Best For:

- Traders still developing their edge

- Those who value unlimited time horizons

- Risk-averse individuals uncomfortable with evaluation pressure

- Traders whose strategies require multi-week holding periods

The Prop Firm: Scaling with Leased Capital

An options prop firm offers a different value proposition: access to significant simulated capital in exchange for a fee. This is the "fast track" to scaling, but it comes with a heavy regulatory burden.

Best For:

- Traders with proven 90-day track records

- Strategies requiring capital above personal means

- High-discipline individuals who thrive under constraints

- Those comfortable with 70-90% profit splits

Which Path Should You Take?

- Personal Account: Best if you value long-term compounding and have no interest in being "timed" or "graded."

- Prop Firm: Best if you have a proven trading edge but lack the capital to make a living wage. Many find that futures prop trading is changing the game for retail investors by offering similar high-leverage opportunities with slightly different risk parameters.

Final Verdict: Is an Options Prop Firm Worth the Fee?

Deciding whether a prop firm for options trading is worth the investment requires a cold look at your performance. These firms are not "get rich quick" schemes; they are professional-grade tools.

When the Fee is a Justified Investment

The entry fee should be viewed as the cost of "renting" institutional-grade leverage. A prop firm is worth the fee if:

- You have a proven strategy: You have spent months in simulated capital environments and can demonstrate a consistent profit factor above 1.5.

- You need to bypass the "Savings Gap": Instead of spending years slowly compounding, you can immediately access significant buying power.

- You value risk containment: The maximum drawdown rules prevent you from losing your personal life savings during a market outlier event.

- You pass the 90-day test: If you can't trade profitably for 90 consecutive days in a personal simulator, you won't pass a 30-day evaluation with added pressure.

When the Fee is Wasted Money

The evaluation fee becomes a donation to the firm when:

- You're still learning options basics (Greeks, spreads, theta decay)

- You've never tracked your win rate or profit factor

- You trade emotionally or chase losses

- Your strategy requires multi-week holding periods (prop rules prohibit this)

The Bottom Line

An options prop firm is a powerful accelerator, but it is not a teacher. It is a resource for those who have already mastered the Greeks and disciplined execution. If you can navigate the strict risk parameters without emotional volatility, the fee is a small price to pay for professional-level capital. But if you're hoping the evaluation will "force" you to become disciplined—you're paying to learn an expensive lesson about leased freedom.

FAQ

1. Are options prop firms legal in the United States?

Yes, most online prop firms operate as "service providers" rather than broker-dealers because they provide access to simulated capital rather than actual market securities. However, traders should always verify the firm's terms of service and regulatory disclosures.

2. Can I trade 0DTE options in a prop firm?

Many firms allow 0DTE (Zero Days to Expiration) trading, but it is highly risky. Due to the strict maximum drawdown and daily loss limits, the extreme volatility of 0DTE options often leads to rapid account violations.

3. What is the difference between a trailing drawdown and a static drawdown?

A trailing drawdown moves up as your account balance increases, "locking in" the distance from your peak equity. A static drawdown is fixed at a specific dollar amount below your starting balance. Trailing drawdowns are much harder to pass because they don't move back down if you give back some profits.

4. Do I need to be a professional trader to join?

No, the online evaluation model is designed for retail traders. However, you must demonstrate professional-level discipline to pass the evaluation phase and maintain a funded account.

5. How long does it take to get paid?

Payout schedules vary by firm. Reputable firms typically offer weekly or bi-weekly payouts once you have reached a minimum profit threshold and have traded for a required number of days.

6. How does Manic.Trade differ from prop firm evaluation models?

Manic.Trade eliminates the evaluation trap entirely—but with a fundamentally different trading model. Instead of simulated capital with trailing drawdowns and 30-day pressure windows, you trade your own funds in ultra-short 30-second to 5-minute windows on Solana. There's no "evaluation phase" hunting your stops because there are no traditional stop-losses—positions auto-close based on time, not arbitrary drawdown triggers. Prop firms profit from 95% evaluation failures through psychological pressure; Manic.Trade removes that game entirely by forcing traders to focus purely on directional momentum calls. You keep 100% of gains, execute at sub-400ms with Pyth oracles, and never face the "Am I about to hit max drawdown?" anxiety that prop firms engineer.

7. Why is Manic.Trade's 30-second to 5-minute window better than prop firm unlimited hold time?

Because it eliminates the psychological warfare prop firms use against you. Unlimited hold time sounds like freedom, but it's actually a trap: the longer you hold, the more you second-guess, revenge trade, and trigger arbitrary stop-losses during liquidity sweeps. Manic.Trade's forced exit window creates discipline by design—you can't hold losing positions hoping for reversals, and you can't let winning trades turn into losers through greed. In prop firms, traders fail because they can't manage themselves over 30 days. On Manic.Trade, the platform enforces what professionals already know: in high-frequency markets, the best trade is the one you exit quickly. Our sub-second Pyth pricing ensures you capture the momentum spike in that 30-second to 5-minute window before the crowd even sees the move.

Related Reading

This article is part of our comprehensive guide: Trading Psychology for High-Frequency Scalping: The Complete Mental Discipline Guide.

Discover why 90% of scalpers fail psychologically, the 5 core mental traps destroying traders, and the architectural solutions that eliminate discipline failure without relying on willpower.

Continue Your Journey: Master Risk Before Leverage

Before paying for evaluation fees, master these fundamentals:

🛡️ The Wake-Up Call: MT4 Not Enough Money Is the Signal to Fix Your Risk Management System

Prop firms liquidate at maximum drawdown instantly—no mercy, no second chances. 'Not Enough Money' errors teach the same lesson: without proper risk management, leverage amplifies destruction faster than it amplifies profits.

🧩 Complexity is a Trap: Why the Iron Condor Might Be Distracting You from the Trend

Prop firms restrict holding periods and force intraday scalping—exactly the environment where complex strategies fail. Master simple directional conviction before attempting multi-leg spreads under time pressure.

⚡ The Art of Momentum Trading: How to Master Micro-Trends in Seconds

Prop evaluations reward speed and precision—the exact skillset momentum trading teaches. Learn to identify structural breaks without relying on macro patience that evaluation windows prohibit.

💡 Minimalist Trading: Why the Best Scalping Strategy Is Doing Less, Not More

The 95% failure rate exists because traders overcomplicate under pressure. Prop firms amplify this tendency. Simplify your process in a personal account first—complexity under evaluation constraints guarantees failure.

Start Trading Smarter with Manic.Trade

Ready to trade with your own capital at institutional speed—without evaluation fees, time pressure, or profit splits? Manic.Trade provides sub-second execution on Solana with zero artificial constraints.

Join the Manic.Trade Community:

🌐 Official Website: Manic.Trade

🐦 X (Twitter): @ManicTrade

🎮 Discord: Join the Server

✈️ Telegram: Official Channel

Experience the platform built for traders who own their capital and their destiny—no leased freedom required.

Explore More Trading Resources

Solved your immediate problem? Go deeper:

- Trading Psychology Guide - Why discipline fails and how architecture solves it

- Momentum Trading Guide - Pattern recognition and execution frameworks

- Speed Advantage Guide - Infrastructure that multiplies edge

Browse all resources: Trading Tools & Resources Hub

Ready to trade with zero friction? → Start on Manic.Trade