Key Takeaways

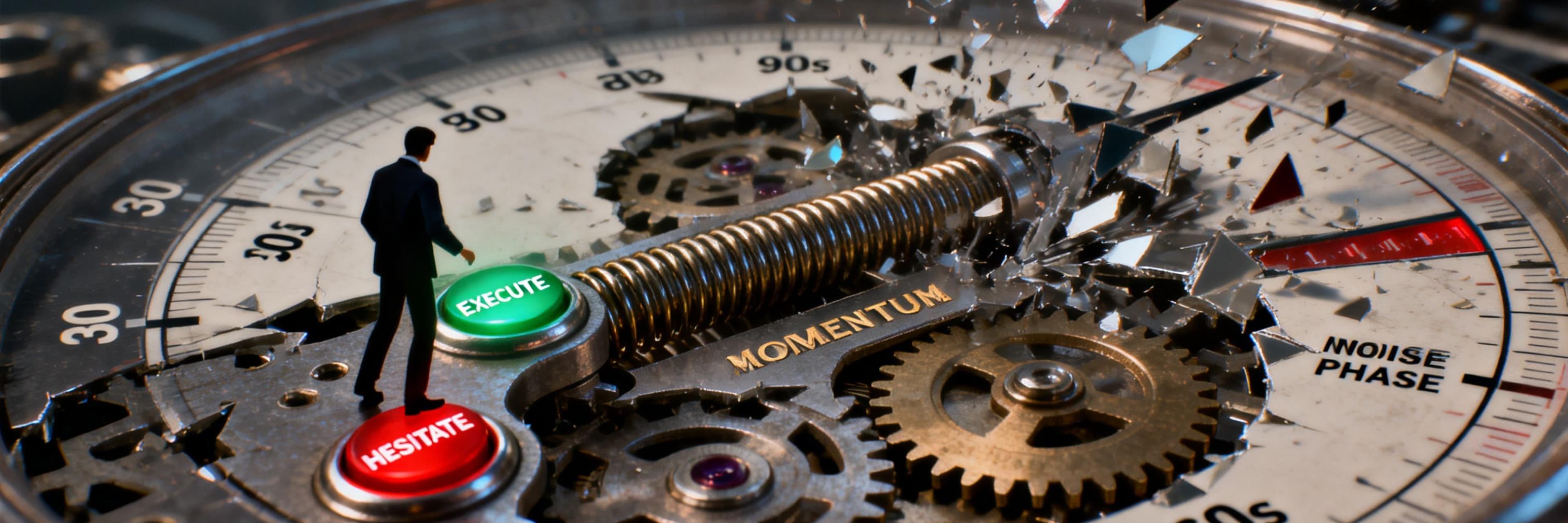

- Execution Speed as Edge: Solayer's sub-second infrastructure on Solana enables 30-second scalps that capture momentum before traditional platforms even register the move.

- Forced Exit Discipline: Time-based windows (30s-5min) eliminate emotional holding and revenge trading—the platform auto-closes, enforcing the scalping rule "exit before decay."

- Micro-Structure Focus: Stop patterns, tight risk (0.2-0.5% per trade), and structure-based invalidation matter more than indicator confluences on ultra-short timeframes.

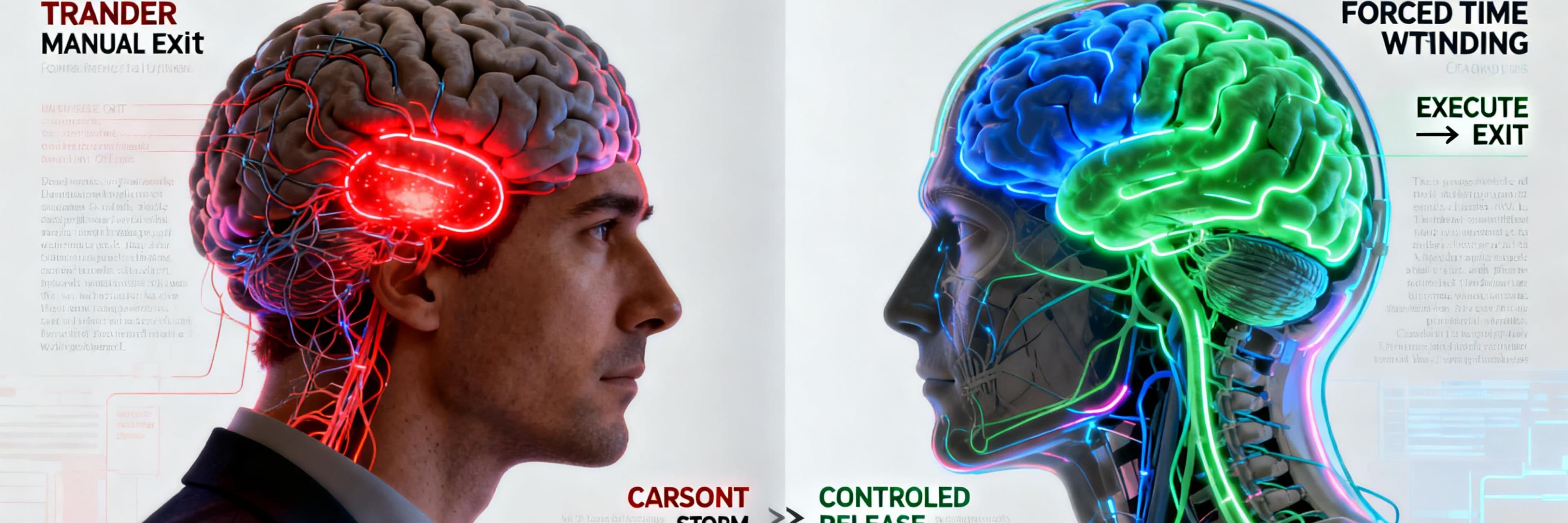

- The Mental Capital Cost: 30-second scalping incurs biological stress—cortisol spikes, decision fatigue. Success requires infrastructure that removes hesitation, not more indicators.

Quick Answer: Is 30-Second Scalping on Solayer Profitable?

If you're searching for proven ultra-short scalping strategies, here's what most YouTube tutorials won't tell you: Profitability depends on execution infrastructure, not pattern recognition. While traders analyze 1-minute RSI crosses, successful 30-second scalpers focus on order flow sweeps, sub-50ms latency, and forced exit windows that prevent the #1 killer—holding too long into noise.

Key Requirements:

- Platform latency: <50ms (Solayer's Solana advantage)

- Risk per trade: 0.2-0.5% maximum

- Target: 5-12 pips with 60-90 second mandatory exit

- Win rate: 55-65% with 1.5:1 minimum reward-risk

- Psychological discipline: Time windows enforce exits, removing "should I close?" anxiety

Bottom line: 30-second scalping on Solayer works IF you have sub-second execution and forced time windows. Without both, you're not scalping momentum—you're gambling against noise. Traditional platforms make you manage exits manually, creating hesitation. Solayer's time-based auto-close removes the decision, removing the failure point.

Understanding Solayer 30 Sec Scalping: The Infrastructure Advantage

Focus on quick entries and exits, tight risk limits, and using short‑term order flow signals. Execution speed, clear rules, and strict stop placement drive trade decisions—but infrastructure determines whether you capture the move or become the liquidity.

Core Principles

We trade on speed and high-probability micro-moves. Each setup targets small pip or tick gains on one- to five-minute horizons, most often executed inside 30-second windows. Risk per trade stays small, typically a fixed percent or fixed tick amount, and position sizing ensures a stop loss stays affordable.

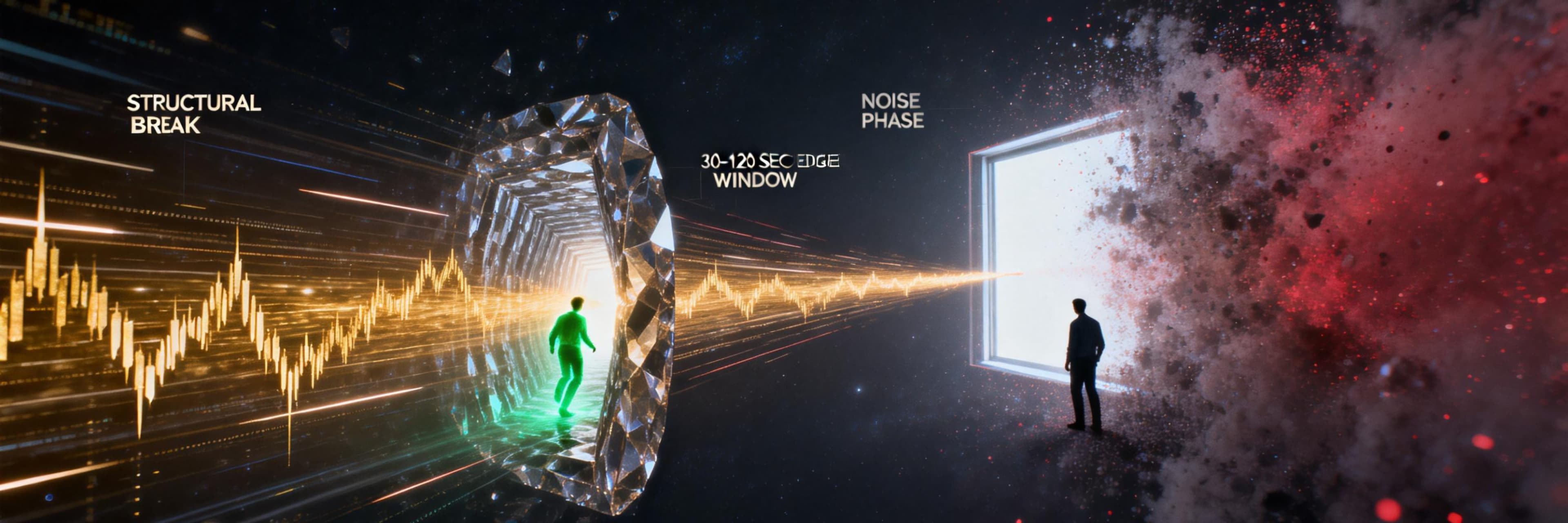

Why 30 seconds to 5 minutes matters: The market doesn't respect your analysis after the initial momentum burst. The first 30-120 seconds of a structural break (CHoCH, liquidity sweep, breakout confirmation) represent institutional absorption. After that, you're trading noise, not flow. Traditional scalpers hold 5-15 minutes hoping indicators confirm the move. By then, the edge is gone.

Priority is clean order flow reads: sudden volume spikes, clustered market orders, or rapid bid/ask shifts trigger entries. Ignore weak, choppy markets and only trade when liquidity and volatility align with your edge. Discipline around stops and fast exits protects capital—not from being "wrong," but from holding past the momentum window.

This mirrors why the art of momentum trading emphasizes structural breaks over lagging indicators—you're capturing the explosion, not analyzing the aftermath.

How the Strategy Works

Watch a 30‑second chart or a 1‑second order flow feed and wait for a specific trigger pattern. Typical triggers include a quick sweep of liquidity followed by rejection candles or a narrow-range breakout on high volume. Enter on confirmation—often the second candle after the trigger—to reduce false signals.

Set tight stops just beyond the recent liquidity sweep and place conservative take‑profits, sometimes using a moving trailing stop once price moves in our favor. Aim for multiple small wins per session and cut losses fast. Execution tools like hotkeys, one‑click orders, and low latency data matter for consistent results—more than any indicator combination.

Key Terminology

- Liquidity sweep: Rapid market orders clearing resting limit orders at one side of the book.

- Rejection candle: A candle that quickly reverses after testing a price level, showing rejection.

- Order flow: Real‑time view of market orders, sizes, and aggressiveness—used to time entries.

- Sweep and reject setup: Sweep triggers stop runs; reject shows failure to continue, signaling entry.

- Tick/Pip sizing: The smallest price unit we use for targets and stops.

- Risk per trade: Fixed dollar or percentage loss we accept before exit.

Use these terms to read the tape and act quickly. Clear definitions keep your system aligned and reduce hesitation during execution. When the sweep happens, you don't have time to debate—you execute or you miss.

💡 Pro Tip: Time Windows Eliminate "Should I Exit?" ParalysisTraditional scalpers face 50 micro-decisions per trade: "Is this the top? Should I take profit now? Will it bounce?" This decision fatigue destroys more accounts than bad entries. When you trade 30-second to 5-minute forced windows, the platform decides exit timing, not your amygdala. You identify the setup (liquidity sweep + rejection), enter the momentum burst, and the system auto-closes in 30s-5min. No hesitation. No revenge trading when it closes early. No holding past the edge window because "it might come back." The biological stress of manual exit timing—the cortisol spike every time price ticks against you—vanishes. You trade the setup, not your emotions. This is why minimalist trading principles emphasize removing decisions, not adding indicators.

Setting Up for Solayer 30 Sec Scalping: Platform and Tools

Need a fast, stable platform, focused chart layouts, and tight indicator settings. These three items determine execution speed, signal clarity, and risk control.

Required Trading Platforms

Use a low-latency broker with direct market access or ECN pricing to reduce slippage. Choose a broker that shows real-time tick data and supports one-click order entry or hotkeys.

Use a platform that can display sub‑minute charts (15s–1m) and runs custom indicators or scripts. Popular choices include MetaTrader 5 with a VPS, TradingView Pro for alerts and fast redraws, or a native DMA platform offered by your broker. Test order fill times during active market hours—if your test order takes 200ms+ to confirm, your infrastructure will bleed edge.

Run the platform on a local SSD or a nearby VPS if your internet is unstable. Keep CPU and RAM usage low: close unused applications, and disable automatic updates during sessions.

Solayer advantage: Built on Solana's 400ms block finality, Solayer provides the infrastructure speed 30-second scalping demands. Traditional Ethereum-based platforms with 12+ second block times negate sub-second execution advantages—by the time your transaction confirms, the momentum window closed.

Tips:optimize execution speed for 30-second scalps.

Optimal Chart Timeframes

Anchor entries on a 30-second chart and confirm with a 1-minute chart. The 30s gives entry precision; the 1m reduces false signals.

Add a 3-minute or 5-minute chart as a divergence and trend filter. Use the higher timeframe to spot support/resistance and momentum direction. Avoid using only one timeframe—multi-timeframe checks cut losses from noisy 30s signals.

Keep charts synchronized: same symbol, same session template, and aligned time zones. Use candle or tick charts depending on instrument liquidity; tick charts can offer cleaner micro‑structure in very active pairs or futures.

Critical distinction: You're not analyzing patterns—you're identifying momentum bursts. The 30s chart shows order flow shifts. The 1m chart confirms it's not a single-whale spike. The 3-5m chart ensures you're aligned with higher timeframe bias. This is the same principle as visualizing velocity patterns—compression predicts expansion, not lagging indicators.

Indicator Configuration

Favor lightweight indicators with strict rules. Use a short EMA (e.g., 8 EMA) and a slightly longer EMA (e.g., 21 EMA) on the 30s for trend and entries. Require the 8 to cross or touch the 21 in direction of trade before considering entries.

Add RSI set to 7 or stochastic set to fast settings (5,3,3) to detect overbought/oversold on the 30s. Use a 14‑period RSI on the 1m for confirmation. Place a small ATR (e.g., 14) on 1m to size stop-loss and set take-profit multiples.

Enable visual alerts and sound for crosses and divergences only. Keep indicators minimal to avoid repainting and lag. Test settings in a demo for at least 50–100 trades before going live.

Warning: More indicators ≠ better edge. On 30-second timeframes, each additional indicator is another source of contradictory signals creating paralysis. If you have 5 indicators and they all need to align, you'll miss 80% of valid setups waiting for perfect confluence that never comes. This is exactly why complexity is a trap—simplicity executes, complexity hesitates.

| Timeframe | Purpose | Key Indicators | Decision Weight |

|---|---|---|---|

| 30-second | Entry precision | 8/21 EMA, RSI(7), Order Flow | 40% (execution timing) |

| 1-minute | Confirmation filter | RSI(14), Volume spike, CHoCH | 35% (false signal filter) |

| 3-5 minute | Trend bias | EMA direction, Support/Resistance | 25% (alignment check) |

Executing Trades with Solayer 30 Sec Scalping: Precision Over Prediction

Focus on tight, repeatable rules to enter, exit, and control costs. Precision matters: entries use the 30‑second chart, confirmation on 1‑ to 3‑minute charts, and strict money management on every trade.

Entry Criteria

Enter only when three conditions align. First, on the 30‑second chart price must break a short‑term micro structure: a clear candle close beyond the recent 3–5 bar high or low. That gives immediacy and a defined reference for stops.

Second, a higher‑timeframe check on the 1‑minute or 3‑minute chart must not contradict the move. If the 1‑minute shows a divergence, flat consolidation, or a strong countertrend candle, skip the trade.

Third, volume or tick activity should spike above the last 10 bars on the 30‑second chart. Require this to filter false breaks. Entry types: market entry on immediate break for speed, or limit entry slightly inside the breakout to improve risk/reward when spread and latency allow.

Risk per trade stays small. Size positions so a stop equal to 0.2–0.5% of account equity would be the maximum loss on any single trade. Record every entry reason in your log for later review.

The biological reality: Your amygdala will scream "TOO FAST!" when valid setups appear. This is why 90% of scalpers fail—not from bad analysis, but from hesitation during execution. The liquidity sweep happens, the rejection candle forms, your checklist confirms...and you freeze. By the time you convince yourself, the 30-second window closed. Forced time windows remove this failure point—you either execute within the setup window or you don't trade. No negotiating with your fear.

Exit Strategies

Use fixed micro targets and dynamic exits together. Primary target sits at 5–12 pips (or equivalent ticks) depending on instrument volatility. Place a first take‑profit at the target and a stop just beyond the 3–5 bar opposite extreme.

Trail the stop when price reaches 50–75% of the target. For trailing, use the close of a 30‑second candle or a moving average crossover on the 30s to lock profits. If price momentum collapses before reaching target, exit on a two‑bar reversal pattern.

Also apply time‑based exits: if a trade has not hit target within 60–90 seconds, close it. This prevents holding into noise and reduces exposure to sudden reversals. The market doesn't care about your target—if momentum dies in 45 seconds, holding for 5 minutes just adds risk with zero additional edge.

Manic.Trade advantage: The platform enforces 30-second to 5-minute windows automatically. You don't manually decide "should I close now?" The system closes at time expiration. This eliminates the #1 scalping killer: holding past the momentum window hoping price "comes back." It won't. Noise doesn't have direction. Exit before noise begins.

Managing Transaction Fees

Calculate fees before sizing positions. For each pair or index, total spread + commission per round trip and subtract that from the expected target. If fees consume more than 40–50% of the target, avoid that instrument.

Prefer brokers with low latency and tight spreads. When latency is higher, reduce order size or use limit entries to offset slippage. Batch review trades daily to track average slippage and fee impact.

Practical tips:

- Keep a running column in the trade log for spread, commission, and slippage.

- Adjust the minimum target by average fees + 20% buffer.

- If fees rise, pause trading until conditions improve.

Cost structure reality check:

Example: BTC/USD 30-second scalp

- Entry: Market order (3 pip spread)

- Exit: Market order (3 pip spread)

- Commission: 0.5 pip equivalent

- Total cost: 6.5 pips

- Target: 10 pips

- Net profit: 3.5 pips (35% eaten by costs)

Solution: Either increase target to 15+ pips OR switch to limit orders (1 pip spread) reducing costs to 3 pips total.

This is why proper risk management systems emphasize cost-aware position sizing—ignoring transaction costs is slow account death.

⚡ Reality Check: Most "Profitable" Scalpers Lose to FeesWin rate 60%, average win 8 pips, average loss 8 pips—sounds breakeven before costs, right? Wrong. Add 6 pips round-trip costs: your 8-pip wins become 2-pip wins, your 8-pip losses become 14-pip losses. Now you're bleeding 2.4 pips per trade on average despite 60% win rate. Over 100 trades: -240 pips. Over 1000 trades: account blown. This is why 30-second scalping only works on low-spread, low-latency infrastructure. Solayer's Solana base provides tighter effective spreads than Ethereum L2s (no multi-block confirmation lag inflating slippage). Before you optimize entries, optimize costs. Execution infrastructure determines if scalping is profitable or expensive practice.

Risk Management Techniques: Structure-Based Stops and Position Sizing

[📸 IMAGE POSITION 4: Risk Management Visualization] <!-- IMAGE PLACEMENT: After "Risk Management Techniques" H2, before "Position Sizing" H3 IMAGE TYPE: Data/concept visualization PROMPT THEME: Clean data aesthetic RECOMMENDED: Stop-loss placement comparison (structure vs arbitrary) FILE NAME: solayer-risk-management-stops.jpg ALT TEXT: "Comparison visualization of structure-based stop placement versus arbitrary pip stops - showing why structure survives sweeps" -->

Focus on keeping losses small, controlling position size, and placing stop-losses that match the 30-second scalping rhythm. Rules tie risk per trade to account size and the instrument's tick/cent value.

Position Sizing

Set a fixed percentage of equity risk per trade, usually 0.25–0.5% for 30‑second scalps, to limit drawdown from many small losses. For example, on a $50,000 account at 0.3% risk, max loss per trade is $150. Convert that dollar risk into position size by dividing $150 by the stop-loss distance in dollars or ticks.

Also adjust for volatility and spread. If the market shows larger micro-moves or the spread is wide, reduce contracts/shares. Keep a simple worksheet or calculator:

- Account size × risk% = $ risk

- $ risk ÷ stop distance = position size

Round down to whole contracts/lot sizes and cap concentration (no more than 10–15% of daily risk across simultaneous trades).

The mental trap: Traders increase size after wins thinking "I'm on a streak." Your edge doesn't compound—variance does. After 3 wins in a row, the probability of the next trade being a winner is still 55-65%, not 80%. But your emotional confidence says "increase size." This is how profitable systems blow up. Fixed percentage per trade removes this decision.

Stop-Loss Placement

Place stops based on recent 30‑second price structure, not arbitrary percentages. Use the prior 1–3 bars' highs/lows or a short ATR (e.g., 30‑sec ATR × 1.2) to set a stop that survives normal micro-noise but limits a breakout loss.

Convert that stop distance to dollars and ensure it fits the position-size risk. If the stop would exceed per‑trade risk cap, reduce size or skip the trade. Prefer hard stops at the exchange or broker level to avoid emotion and slippage, and account for typical slippage by adding a small buffer (1–2 ticks) into stop placement.

Review stop performance daily and tighten or loosen parameters when consistent patterns of stop hunts or excessive slippage appear.

Structure vs distance stops:

Arbitrary stop: "I'll risk 10 pips"

→ Placed 10 pips below entry regardless of structure

→ Gets swept when price tests recent low (liquidity grab)

→ Then reverses in your favor without you

Structure-based stop: "I'll invalidate if recent low breaks"

→ Placed 1-2 ticks below the liquidity sweep level

→ Survives normal noise

→ Only stops if the structural setup invalidates

Example: BTC sweeps $42,850 low to $42,845, rejects to $42,900

- Arbitrary 10-pip stop at $42,890 = stopped out at $42,890

- Structure stop at $42,840 = survives sweep, exits at $42,920 target

This is the same principle as why price action on 5-minute charts focuses on structure—levels mean something, distance means nothing.

| Stop Type | Placement Logic | Survival Rate | Why It Works/Fails |

|---|---|---|---|

| Arbitrary Distance | X pips/ticks from entry | 40-50% | Ignores where liquidity sweeps occur |

| ATR-Based | ATR × multiplier | 55-65% | Accounts for volatility but not structure |

| Structure-Based | Below/above recent micro-structure | 70-80% | Respects where institutions hunt stops |

Best Practices and Performance Tracking: Measurable Improvement

Focus on measurable steps that improve signal quality, reduce losses, and keep the system running during live sessions. Below are methods to tighten entries, measure results, and shift rules when the market changes.

Improving Strategy Accuracy

Tune indicators to 30-second bars and test only one variable at a time. For example, adjust SMA length by one tick and run 1,000-trade backtests to see the net P&L and win rate changes. This isolates cause and effect.

Use strict entry filters: spread threshold, minimum volume, and a confirmed candle close. Also require a secondary confirmation—like a momentum spike or a micro-break of structure—before entering. That cuts random noise.

Keep execution latency under 50 ms. Log slippage per trade and reject setups when average slippage exceeds a preset limit. Document every parameter set so you can replicate winning configurations.

The optimization trap: You test 10 EMA configurations, find one that delivered 75% win rate in backtest. But it was optimized to past noise, not future signal. When you trade it live, win rate drops to 45%. This is curve-fitting. The solution? Test on out-of-sample data (last 30 days) that the system has never seen. If the edge holds, it's real. If it vanishes, it was overfitting.

Analyzing Trade Results

Track each trade with the same data fields: timestamp, instrument, size, entry, exit, fees, slippage, and outcome. This makes automated reports reliable and easy to query.

Use these metrics in reports:

- Net P&L and P&L per 1,000 trades

- Win rate and average win/loss

- Maximum drawdown and consecutive loss streaks

- Slippage and fills as a percentage of target

Slice results by session, instrument, and time-of-day. That reveals when the 30-second setup works best. Run replays of bad streaks to spot execution or signal errors.

Key insight tracking:

Week 1: Win rate 58%, avg win 9 pips, avg loss 8 pips, net +12 pips/trade

Week 2: Win rate 62%, avg win 9 pips, avg loss 8 pips, net +14 pips/trade

Week 3: Win rate 48%, avg win 9 pips, avg loss 8 pips, net -2 pips/trade

Question: What changed in Week 3?

Answer: Market shifted from trending to choppy (check ATR and volume patterns)

Action: Pause trading or switch to breakout-only setups until trending resumes

Adapting to Market Conditions

Build rule sets that switch based on volatility and spread. For example, widen stop targets during news spikes or pause scalping for 10 minutes when spread > 1.5x normal. Those concrete triggers reduce ad-hoc decisions.

Monitor a small set of real-time indicators: 1-minute ATR, bid-ask spread, and live volume. When ATR rises above threshold, either reduce position size or shift to lower-frequency trades. Log each switch automatically.

Update parameters quarterly and after any sequence of 100 consecutive trades with a positive or negative net P&L change > 5%. Treat adaptation as controlled experiments: change one rule, test for at least 2,000 trades or two weeks of live data, then accept or revert.

Market regime detection:

Trending regime (ATR > 0.5%, Volume > avg):

→ Use momentum continuation setups

→ Trail stops aggressively

→ Hold for 60-90 seconds

Choppy regime (ATR < 0.3%, Volume < avg):

→ Use only liquidity sweep reversals

→ Fixed targets, no trailing

→ Exit at 30-45 seconds

News/event regime (Spread > 2x normal):

→ Pause all entries until spread normalizes

→ Prevents getting filled at terrible prices during volatility spike

🎯 Master Conditional Execution Before Scaling VolumeMost scalpers blow up not from bad strategy, but from trading the same setup in all conditions. Your momentum continuation setup that wins 65% in trending markets wins 35% in choppy markets—but you don't realize it until you've lost a week's gains in two hours. Before you increase position size, master regime detection. When ATR drops below threshold, your edge drops with it. When spread widens to 2x normal, your cost structure just destroyed your reward-risk ratio. The pros don't trade 8 hours straight—they trade 2-3 hours when their edge is highest, then walk away. This is why the best scalping strategy is doing less—concentrated edge beats diluted activity.

FAQ

What makes 30-second scalping different from 1-minute or 5-minute scalping?

30-second scalping captures the initial momentum burst (the first 30-120 seconds after a structural break) before noise dominates. 1-minute scalping often holds through the noise phase hoping for continuation. 5-minute scalping is swing trading on compressed timeframes. The edge window for 30-second setups is narrow but explosive—you're trading institutional absorption, not retail pattern recognition.

What's the minimum account size for 30-second scalping?

$10,000 minimum if risking 0.5% per trade ($50 risk). Below this, position sizing becomes impractical (fractional lots create odd fills), and psychological pressure from dollar amounts distorts decision-making. Ideal range: $25,000-50,000 where 0.3% risk ($75-150) provides comfortable position sizing across most instruments.

How many trades should I expect per day with this strategy?

Quality over quantity: 5-15 setups per session (3-4 hour trading window). If you're taking 30+ trades, you're chasing noise, not edge. The valid liquidity sweeps with rejection confirmation happen 1-2 times per hour in liquid markets. More trades = more fees, more slippage, more emotional exhaustion.

Can I use this strategy on stocks or only crypto/forex?

Works on any liquid instrument with tight spreads: FX majors (EUR/USD, GBP/USD), crypto majors (BTC, ETH), index futures (ES, NQ). Avoid: low-volume alt-coins (spread eats profit), individual stocks (gaps between quotes create execution issues). The key is bid-ask spread < 30% of your target.

What's the biggest mistake new 30-second scalpers make?

Holding past the momentum window because "it might come back." It won't. After the initial 30-120 second burst, you're trading noise, and noise has no direction. The second-biggest mistake: over-leveraging because "small targets need big size." This compounds losses during losing streaks. Fixed percentage risk per trade removes both failure points.

How does Solayer's 30-second to 5-minute window compare to manual scalping?

Traditional scalping forces you to manage exits manually—you watch every tick, fight your amygdala screaming "CLOSE NOW" or "HOLD LONGER," and make 50 micro-decisions per trade. Solayer's forced time windows eliminate this biological warfare. You identify the setup (liquidity sweep + rejection), enter the momentum burst, and the platform auto-closes in 30s-5min. No decision fatigue. No revenge trading. No cortisol spikes from holding through reversals. You trade the explosive moment, then you're out before noise begins.

Does Solayer use different indicators than traditional scalping platforms?

Solayer doesn't rely on lagging indicators—it uses real-time order flow and sub-second price feeds. Traditional platforms calculate RSI/MACD on the last 14-26 candles (historical lag). During your 30-second hold, lagging indicators update once or twice. Real-time order flow shows institutional absorption happening right now, not 30 seconds ago. You're reacting to the move as it occurs, not trading the echo. This is why Solayer scalpers don't need 5 indicators confirming each other—they see the liquidity sweep and rejection in real-time, eliminating the need for lagging confirmation entirely.

Continue Your Journey: From Theory to Execution

Master the foundations before scaling size:

📊 Visualizing Velocity: Spot Price Squeezes Without Indicators

30-second scalping trades compression → expansion patterns. Learn to read visual price contraction that predicts breakouts before indicators react—the same pattern institutional scalpers use.

⚡ The Art of Momentum Trading: Master Micro-Trends in Seconds

Understand why capturing the first 30-120 seconds of a breakout beats holding for "confirmation" that arrives after the edge window closes. Structural breaks create momentum, not indicator crosses.

💡 Minimalist Trading: Why Doing Less Is More

Stacking 5 indicators on 30-second charts creates paralysis. Simplify: one signal type (liquidity sweep + rejection), one execution window, one risk rule—less complexity, more profits.

🧩 Complexity is a Trap: Why Iron Condors Distract from Trends

Over-engineering scalping strategies mirrors over-engineering option plays—more moving parts, more failure points. Master directional simplicity before adding layers.

Start Trading with Zero-Hesitation Execution: Manic.Trade

Why fight your amygdala managing exits when the platform can remove the decision entirely?

Manic.Trade eliminates the #1 scalping killer: No manual exit management. No "should I close now?" anxiety. No holding past the momentum window hoping price comes back. Just 30-second to 5-minute forced windows that auto-close positions, enforcing the discipline 90% of scalpers can't maintain manually.

The Manic.Trade Execution Edge:

- ⚡ Sub-400ms Total Latency: Order submission to confirmation faster than competing platforms process one blockchain confirmation

- 🧠 Zero Exit Anxiety: Platform closes at time expiration—you trade the setup, not your emotions

- 🎯 Momentum Window Precision: Capture the explosive 30-120 second absorption phase, auto-exit before noise begins

- 💰 Tighter Effective Spreads: Solana's 400ms finality prevents multi-block confirmation lag that inflates slippage on other chains

The infrastructure difference: Traditional platforms make you manage exits. Manic.Trade manages exits for you. This isn't automation for convenience—it's removing the biological failure point that destroys scalpers.

Join the Manic.Trade Community:

🌐 Official Website: Manic.Trade

🐦 X (Twitter): @ManicTrade

🎮 Discord: Join the Server

✈️ Telegram: Official Channel

Stop fighting manual exit decisions. Start trading forced discipline: Manic.Trade—where time windows remove hesitation.

Explore More Trading Resources

Solved your immediate problem? Go deeper:

- Trading Psychology Guide - Why discipline fails and how architecture solves it

- Momentum Trading Guide - Pattern recognition and execution frameworks

- Speed Advantage Guide - Infrastructure that multiplies edge

Browse all resources: Trading Tools & Resources Hub

Ready to trade with zero friction? → Start on Manic.Trade